AI’s Poker Breakthrough

An artificial intelligence system named Libratus made history by defeating top human poker professionals in a no-limit Texas Hold’em tournament. Unlike traditional poker programs, which rely on pre-programmed strategies, Libratus used an advanced form of reinforcement learning to refine its gameplay continuously. By analyzing patterns in human decision-making and calculating optimal moves based on probability, it was able to adapt dynamically. The AI’s ability to navigate incomplete information gave it an edge over human players who relied on intuition and experience.

This victory marked a breakthrough in AI’s capacity for strategic reasoning under uncertainty, a skill previously thought to be uniquely human. Unlike board games like chess and Go, poker involves deception, bluffing, and incomplete data, making it an ideal testing ground for AI decision-making. Researchers believe that the same principles that allowed Libratus to dominate poker could be applied to industries where high-stakes decision-making is crucial. One of the most promising areas for this technology is the financial sector, where AI’s ability to analyze risk and predict outcomes could revolutionize trading and investment strategies.

Strategic Thinking at Scale

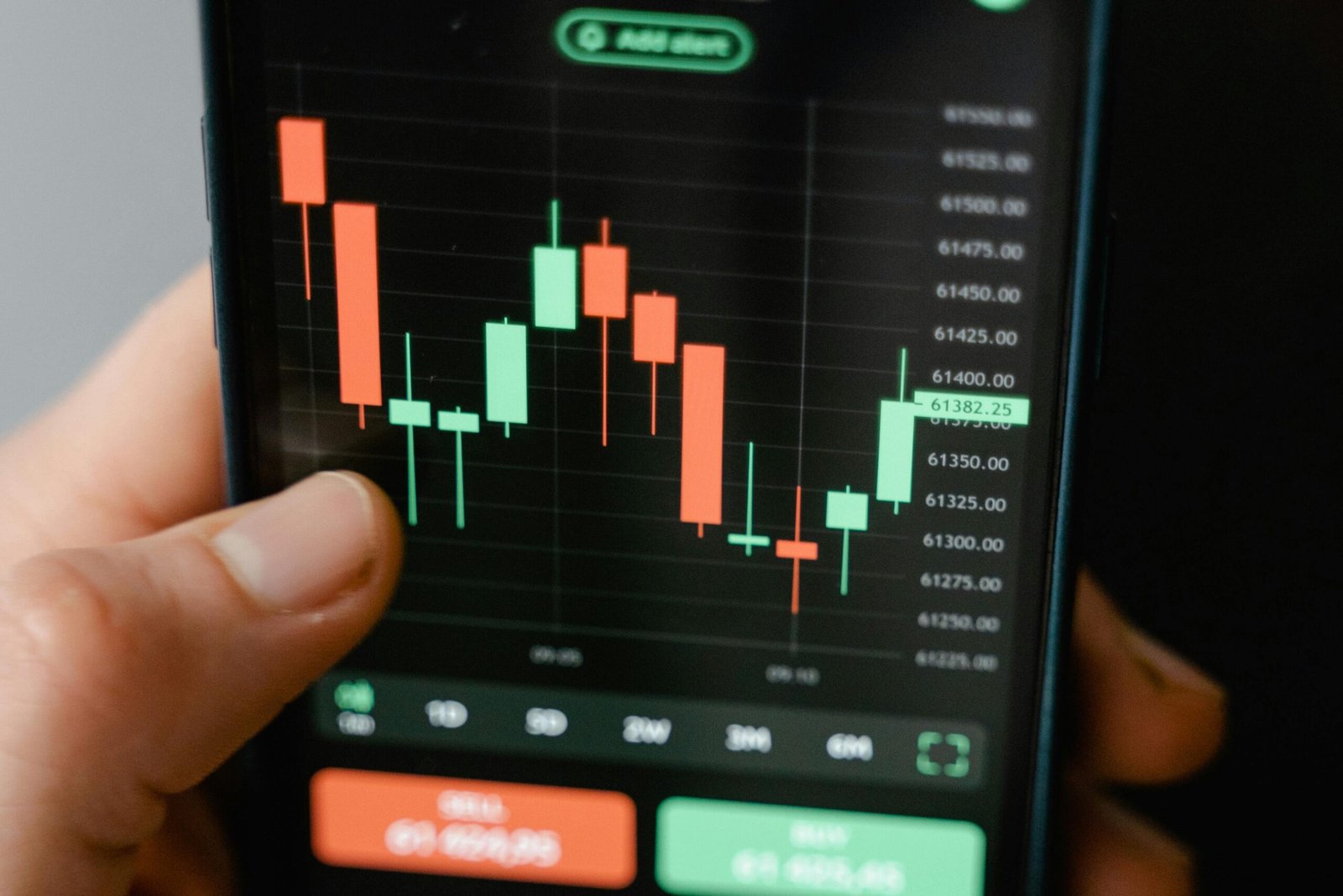

The technology behind Libratus is now being adapted for broader applications, including finance. AI models like DeepStack have demonstrated that machines can outperform humans in complex decision-making environments with incomplete information. This ability is particularly valuable in stock trading, where traders often make decisions based on imperfect data and shifting market conditions. Unlike conventional trading algorithms that follow set patterns, poker-trained AI models use game theory to adjust strategies in real-time.

By applying these principles to financial markets, hedge funds and investment firms are exploring AI-driven trading strategies that can outmaneuver traditional models. These AI systems analyze vast amounts of market data, predict fluctuations, and respond to changing conditions with precision. The adaptability that made AI dominant in poker is now proving valuable in the world of finance, signaling a shift toward AI-driven decision-making in investment strategies. As AI continues to evolve, its ability to assess risk and optimize strategies is expected to redefine how financial markets operate.

The Wall Street Experiment

Investment firms are now testing AI models inspired by game theory and strategic decision-making, hoping to replicate the success seen in poker. Some hedge funds have developed trading algorithms based on reinforcement learning, similar to AlphaZero which mastered chess without human guidance. Unlike traditional AI-driven trading models that rely on historical data, these new systems learn and adapt in real-time. This gives them a significant advantage over human traders, who often struggle to process large volumes of information quickly.

The ability of AI to recognize patterns and identify market inefficiencies has made it a valuable tool for financial institutions looking to maximize profits. Some firms have even implemented AI systems that simulate adversarial trading environments, allowing them to test how their strategies perform against competitive market conditions. While this technology promises greater efficiency, it also raises concerns about potential market manipulation. As AI-driven trading continues to evolve, regulators are closely monitoring its impact to ensure a fair and stable financial landscape.

High-Frequency Trading Meets AI

High-frequency trading (HFT) is one area where AI-trained poker strategies are making a significant impact. Trading firms specializing in executing thousands of trades within milliseconds are integrating AI models like Pluribus, which mastered multiplayer poker. These AI-powered systems excel in rapidly analyzing market fluctuations and executing trades faster than any human trader could. The ability to react instantly to changing conditions gives AI-driven HFT firms a competitive advantage in the fast-paced world of finance.

However, this growing reliance on AI has also sparked debates about the potential risks associated with high-speed automated trading. Critics warn that AI-powered HFT could contribute to sudden market disruptions, such as flash crashes triggered by algorithmic trading patterns. Regulatory bodies are now considering new measures to manage the risks associated with AI-driven trading. As AI technology continues to evolve, its influence on global financial markets is expected to grow, potentially reshaping the dynamics of trading in unprecedented ways.

The Ethical Debate

As AI becomes more involved in financial decision-making, ethical concerns are emerging regarding its potential misuse. The same AI that dominated poker through deception and calculated risks could be used to manipulate financial markets in ways that are difficult to regulate. OpenAI has emphasized the need for clear ethical guidelines to prevent AI-driven trading systems from exploiting loopholes or engaging in unfair market practices. While AI is often praised for its ability to remove human biases from decision-making, its lack of ethical considerations presents a new set of challenges.

The growing autonomy of AI in finance has raised questions about transparency and accountability. Should AI-driven financial decisions be subject to human oversight, or will machines eventually operate with complete independence? Regulators are currently exploring policies to ensure that AI does not disrupt financial stability or give unfair advantages to certain firms. As AI’s role in trading expands, the financial industry must strike a balance between innovation and ethical responsibility to prevent unforeseen consequences.

The Role of AI in Market Prediction

AI’s ability to analyze large volumes of data and detect hidden patterns has positioned it as a powerful tool for market prediction. Unlike traditional analysts who rely on historical trends and economic indicators, AI models process real-time data streams to identify emerging market shifts. This approach allows financial institutions to anticipate price fluctuations with greater accuracy and speed. As AI systems refine their forecasting abilities, they are becoming integral to decision-making in hedge funds and investment firms.

Despite AI’s predictive capabilities, some experts argue that the financial market’s complexity and unpredictability make it impossible to achieve perfect forecasts. Economic events, policy changes, and human sentiment introduce variables that AI models cannot always account for. While AI enhances analytical efficiency, it does not eliminate uncertainty entirely. As the technology evolves, traders must balance AI-driven insights with human judgment to navigate volatile financial landscapes.

AI-Powered Risk Assessment

Financial institutions are leveraging AI to improve risk assessment models, allowing them to make more informed investment decisions. Traditional risk analysis relies on historical data and statistical models, which often fail to account for rapid market shifts. AI enhances this process by continuously analyzing vast datasets, identifying patterns, and adjusting risk factors in real time. This capability helps firms mitigate potential losses by anticipating downturns and responding proactively.

However, AI’s reliance on data-driven decision-making also raises concerns about overfitting and reliance on past trends. Critics argue that AI models may struggle to adapt to unprecedented economic events, such as financial crises or geopolitical upheavals. While AI improves risk assessment accuracy, it is not infallible. The challenge for financial institutions is to integrate AI tools without becoming overly dependent on them, ensuring that human expertise remains a key component of risk management.

Automating Investment Strategies

The financial sector is increasingly embracing AI-driven automation to optimize investment strategies. AI algorithms analyze market conditions, assess portfolio risks, and execute trades based on pre-defined strategies, reducing human intervention. This automation allows investment firms to capitalize on market opportunities with greater speed and efficiency. AI’s ability to process multiple variables simultaneously gives it an edge over traditional investment strategies that rely on static models.

Despite these advantages, concerns remain about the potential loss of human intuition in investment decision-making. While AI excels at data analysis, it lacks the ability to interpret qualitative factors such as political stability, corporate leadership changes, or consumer sentiment. As AI-driven investment strategies gain popularity, the industry must strike a balance between automation and human oversight to ensure optimal performance.

The Evolution of Algorithmic Trading

Algorithmic trading has been a staple in financial markets for years, but AI is pushing its capabilities further. AI-powered trading systems now analyze market trends, predict price movements, and execute trades in milliseconds. Unlike earlier algorithmic models, which relied on static rules, AI systems learn from historical data and adapt to new conditions dynamically. This evolution allows AI traders to respond to sudden market changes with greater accuracy and speed.

However, the increasing complexity of AI-driven trading raises concerns about market stability. Some fear that AI’s rapid decision-making could contribute to volatility, as multiple systems interact and react to each other’s trades. Regulators are monitoring the impact of AI in trading to prevent scenarios where automated strategies trigger unintended market disruptions. As AI continues to shape algorithmic trading, financial institutions must ensure that its benefits outweigh the risks.

The Future of AI in Finance

AI’s growing role in finance is transforming how investment decisions are made, but its long-term implications remain uncertain. While AI has demonstrated impressive capabilities in poker and trading, its potential to fully master financial markets is still debated. Some experts believe that AI will eventually surpass human traders by leveraging vast data resources and refining predictive models. Others argue that human intuition and adaptability will always be necessary in complex economic environments.

As AI-driven finance continues to evolve, industry leaders and regulators must establish ethical guidelines to prevent misuse and ensure fairness. Transparency in AI decision-making, regulatory oversight, and responsible implementation will play crucial roles in shaping the future of AI in financial markets. The technology is here to stay, but its success will depend on how it is integrated into the broader financial ecosystem.

AI and Behavioral Economics

AI’s growing role in financial markets has led to new applications in behavioral economics. By analyzing vast amounts of data on investor behavior, AI can detect patterns in decision-making that humans might overlook. These insights allow financial institutions to anticipate market trends driven by emotions such as fear and greed, helping them develop strategies that capitalize on investor psychology. AI-driven sentiment analysis tools are now widely used to assess public perception and predict stock price movements based on news articles, social media trends, and market reactions.

Despite its potential, AI’s reliance on data-driven insights poses challenges when dealing with irrational or unpredictable human behavior. Financial bubbles, panic-driven sell-offs, and sudden shifts in investor sentiment can be difficult for AI models to anticipate accurately. While AI enhances market analysis, it is still limited by the complexity of human psychology. The integration of behavioral economics into AI systems is an ongoing process that requires constant refinement to improve predictive accuracy in financial markets.

The AI Arms Race in Finance

As AI continues to prove its value in financial markets, competition among firms to develop the most advanced AI trading systems is intensifying. Major investment banks and hedge funds are investing heavily in proprietary AI models that offer a competitive edge in market analysis and trading execution. This AI arms race has led to rapid advancements in machine learning algorithms, with firms constantly refining their models to gain an advantage over competitors. The ability to analyze vast amounts of data in real time and execute high-speed trades has made AI an essential tool for modern financial institutions.

However, this growing reliance on AI has raised concerns about market fairness and stability. If a few firms develop superior AI models, they could dominate financial markets, potentially leading to imbalances in trading dynamics. Regulators are now exploring ways to ensure that AI-driven trading does not create an uneven playing field or contribute to market instability. As financial institutions continue to invest in AI, the challenge will be to harness its power while maintaining transparency and ethical trading practices.

The Limits of AI in Finance

Despite its remarkable achievements, AI is not infallible in financial decision-making. While it excels at processing large datasets and identifying patterns, it struggles with unexpected events such as economic crises, policy changes, or black swan events. Human traders and analysts still play a crucial role in interpreting qualitative factors that AI cannot fully grasp. The unpredictability of global markets means that AI alone cannot guarantee success in investment strategies.

The future of AI in finance will likely involve a hybrid approach, where AI handles data analysis and pattern recognition while human experts provide strategic oversight. This collaboration between AI and human intelligence could lead to more robust financial decision-making, minimizing risks while maximizing opportunities. As AI technology continues to evolve, the key will be to strike a balance between automation and human expertise, ensuring that financial markets remain dynamic and adaptable.